From Hype to Operational Real Estate: Why Flex is Now a Serious Business in the UK

The UK flexible office market is no longer the outsider in commercial real estate. According to the latest report from Spaces to Places, proudly sponsored by Yardi, the UK flexible office sector has transitioned from experimental to essential. Rather than focusing on which operators are scaling fastest, this report widens the lens. It asks: What does maturity really look like for the UK’s flex office industry? And what does that mean for investors, landlords, and occupiers alike?

Key Takeaways from the Report

1. Managed Space Is Reshaping Supply and Demand

Managed offices—self-contained, fitted, and operated on behalf of the occupier—are becoming the norm. In Central London, managed supply has increased by 895% since 2019. Additionally, 78% of 2024 enquiries for spaces under 5,000 sq ft were for fully managed or fitted spaces. Occupiers are prioritising speed, capex avoidance, and hybrid-friendly setups. The traditional lease model is no longer the default for small and mid-size businesses.

2. The Rise of the Brandlord

Landlords such as British Land (Storey), Landsec (MYO), and CEG (Let Ready) are increasingly launching their own flex brands. These in-house models offer more control over experience, pricing, and returns—reflecting a broader move toward Operational Real Estate (ORE), where property performance is judged on operational income rather than passive rent collection.

3. Operational Metrics and Investor Transparency

One of the most compelling signals of maturity is the push toward standardisation. Metrics like RevPAU (Revenue per Available Unit) and average stay length are replacing anecdotal benchmarks. Institutional investors, long cautious about the fragmented nature of flex, are now moving into the space in earnest.

4. Flexible Models Are Replacing Rigid Leases

The report highlights a structural shift: 41% of new operator deals in 2024 were structured as management agreements, up from just 9% in 2019. These agreements allow owners to share in revenue, manage risk, and stay agile in a changing market.

5. Technology as Infrastructure, Not Innovation

Technology isn’t presented in the report as a disruptor—it’s described as infrastructure. A functioning flex business depends on data visibility, integrated systems, and responsive operations. Tech platforms are enabling operators to move from fragmented manual processes to scalable, professional-grade delivery.

As Justin Harley from Yardi notes, “A clear systems and data strategy is essential for flexible workspace operators to improve operational efficiency, boost profitability, and deliver a seamless member experience.”

The UK Flexible Office Market in Transition

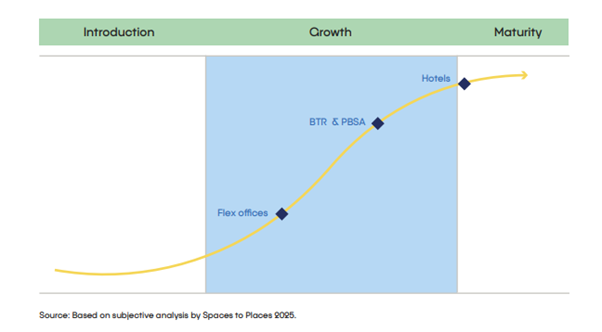

The report doesn’t suggest that flex has “arrived” in full maturity—far from it. But it’s getting close. In fact, the report positions flex alongside operational sectors, such as hotels and build to rent, in terms of how it’s increasingly being valued, regulated, and managed.

It’s a shift in mindset as much as a shift in models. The modern office is no longer just a static space—it’s a service, a product, and increasingly, a business in its own right.

From Hype to Operational Real Estate offers a grounded, data-rich analysis of where the UK flex office sector stands in 2025. It’s not about buzzwords or unicorn valuations. It’s about sustainable growth, operational maturity, and aligning with what occupiers truly want.

For landlords and investors, this means embracing a more hands-on approach—for occupiers, it means more choice, more flexibility, and better-aligned spaces…For the industry as a whole, it means a new chapter—rooted in service, not speculation.

You can explore the full report at Spaces to Places.

Want to find out how Yardi Kube can support the operation and growth of your coworking or flexible workspace? Book a demo with our team here.

Keep in touch with us by following Yardi Kube on LinkedIn!